/ USE CASE

Lucky Financial

/ Problem to solve

Transforming offer experience into seamless digital banking app

Initially, Lucky was designed as an offers and discounts platform use by our customers to get savings. The goal of this project was to transition this platform into a digital banking app where the jobs-to-be-done were opening a bank account to do debit and credit transactions. This transition would involve rethinking the app's features, user interface, and overall user experience to align with the new focus on digital banking.

Insights

+3 Millions

Active users

90%

C1 and C2

85%

of lucky users are unbanked and transact only in cash

71%

of Lucky users would apply to a debit card if lucky offered it

56%

of Lucky users are interested in a credit product

Business goals

“Lucky should be the most seamless and economical way to pay and buy”

Highest merchant-backed rewards & discounts on every purchase

Instant online approval and easy to use from the phone or with the card

“Create the most accessible credit facility in the market”

Most effortless and fastest approval process in the market

The largest merchant acceptance network

Benchmark findings

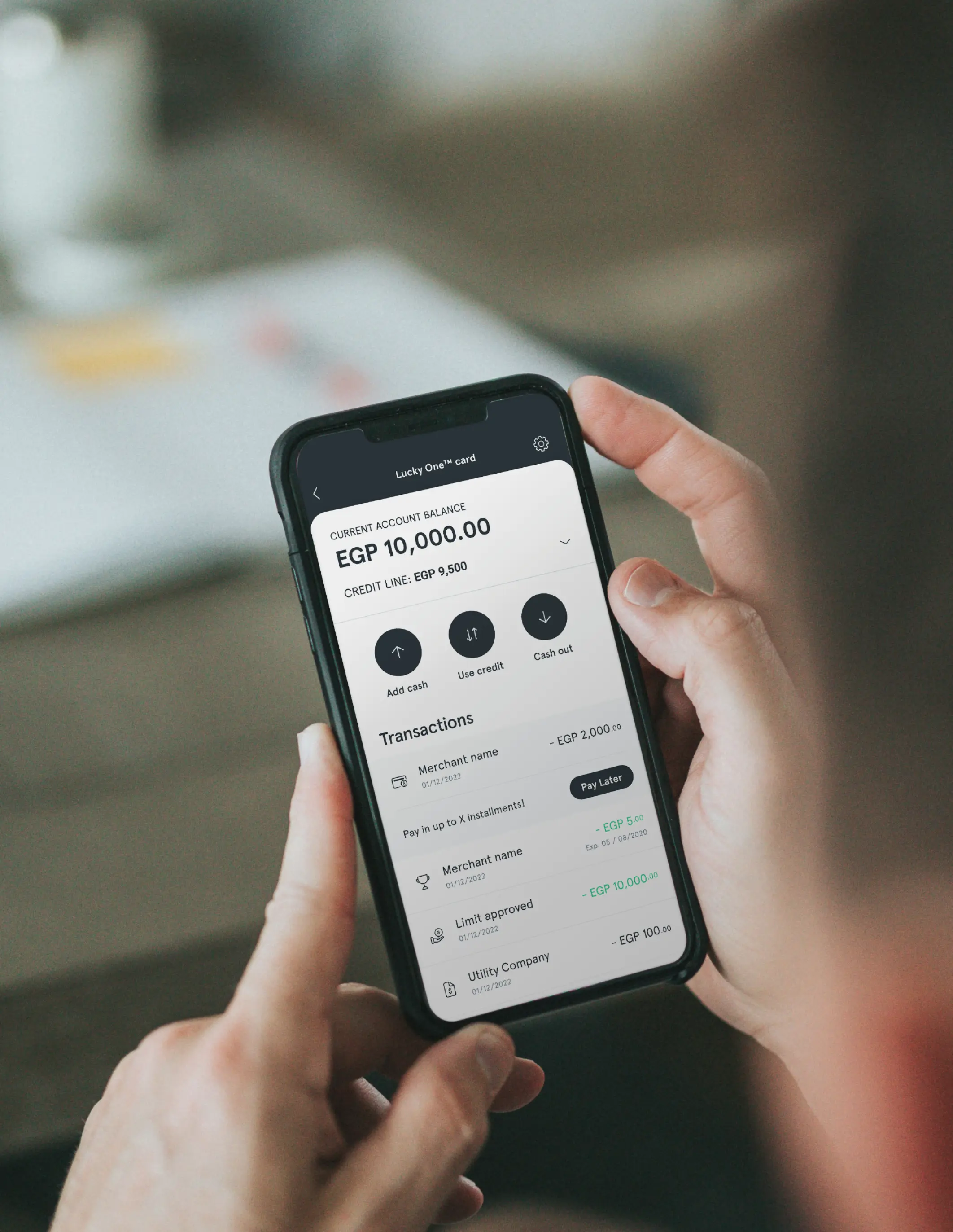

Instant Balances

See your main account balances right on the home screen.

Easy Navigation

Use the bottom bar to move between main sections effortlessly.

Clear Guidance

Banners help you find and take important actions.

Organized Information

Content is neatly divided into sections using boxes for easy browsing.

Seamless online application

Debit and credit card request online with identity verification. Instant approval.

* apps benchmarked

Ideation

Facts

96% find it easy to group sections.

100% of users grouped cards as an isolated section.

83% of users grouped making a payment along with actions such as:

Sending money to a friend.

Buying or paying in installments.

Financial activity is treated separately.

How might we...

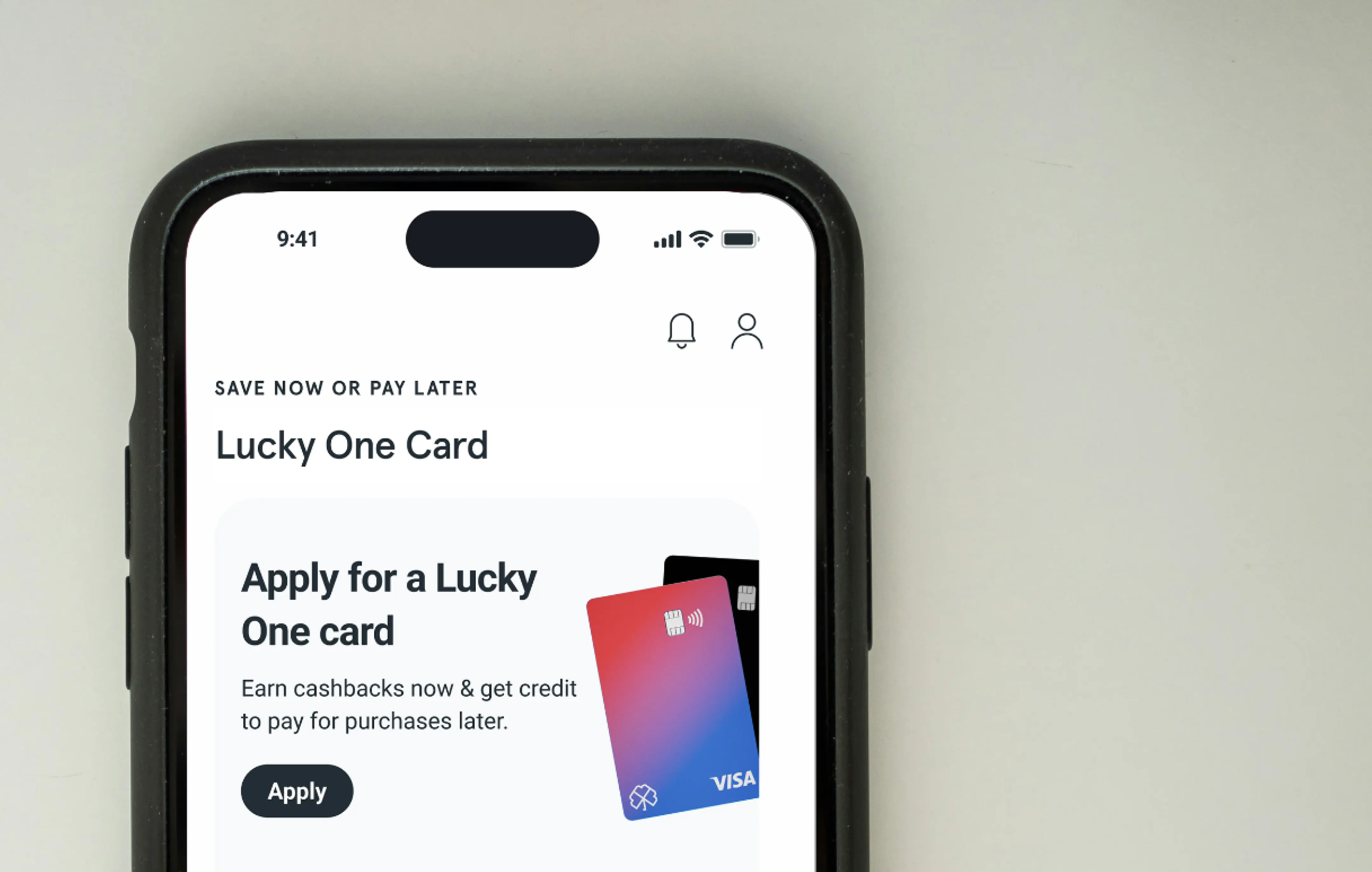

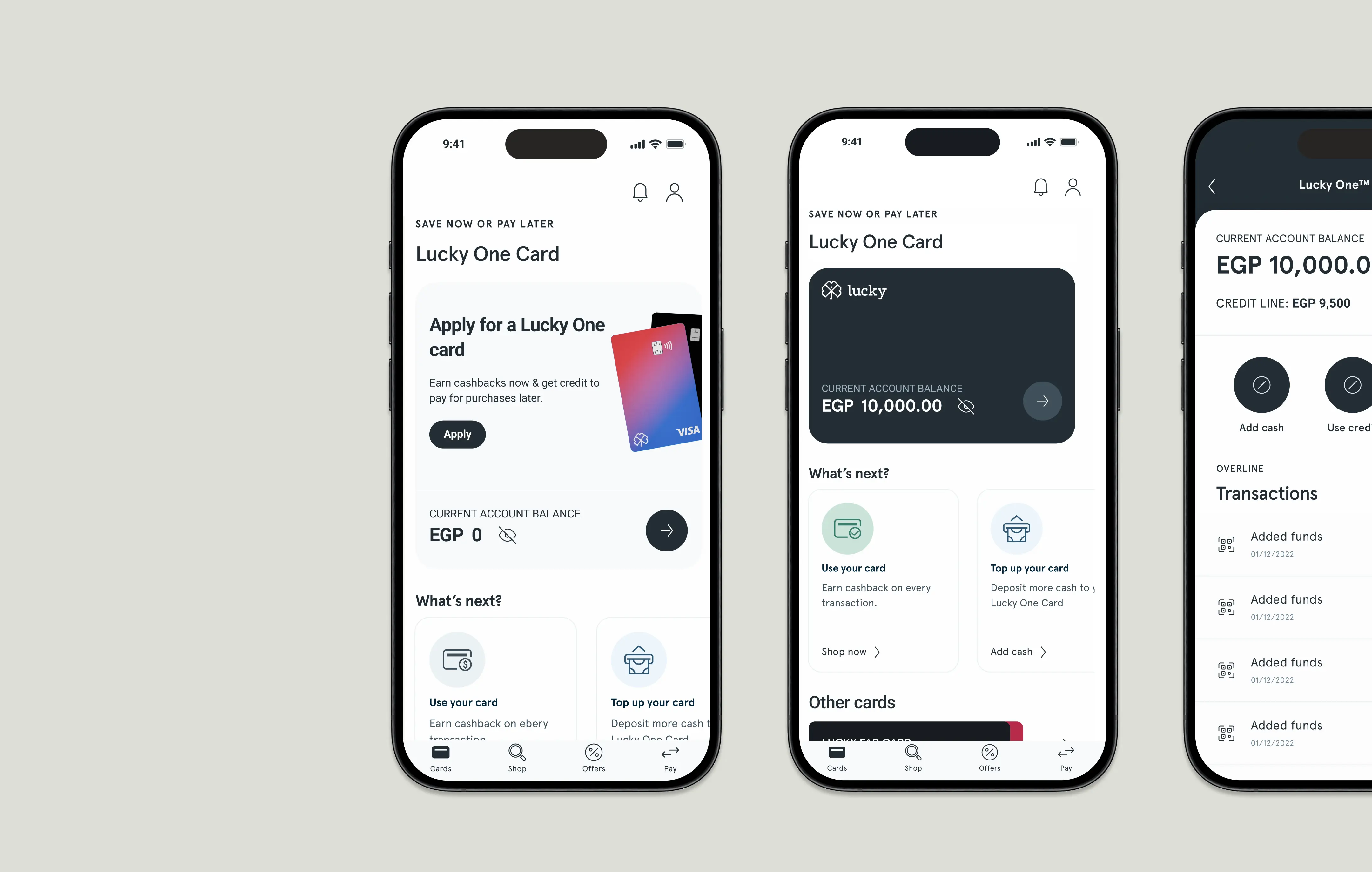

Clarify that Lucky is a bank.

Distinguish financial activity from offer redemption.

Integrate financial activity with the shopping experience.

Simplify the process of making payments online.

Ideas

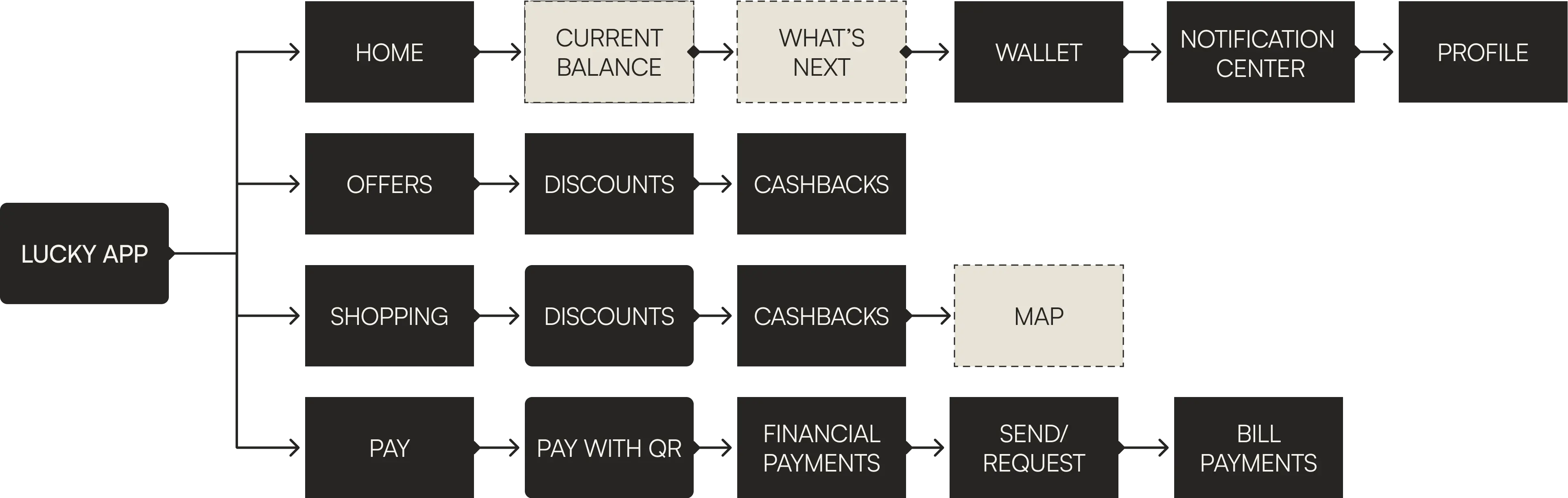

Design a new app structure, focused on the main business goal: applying for a debit card.

Utilize a "What's Next" feature to encourage card usage.

Implement a first-level navigation that allows users to find the main tasks at a glance.

* NEW APP STRUCTURE AND NAVIGATION

/ aftermath

Impact & results

registered users

daily cards issued

monthly users

cards issued

merchants integrated

Testimonials

Perfect application and easy to use

RanaH.

Amazing app and now with their card it’s even better. thanks

BlueA2

This app very useful I think everyone should try this app

Yousefyoya

Main challenges

Cultural barriers

Certain standard banking practices and terminology needed to be changed to align with local customs and religion.

E.g. a segment of orthodox muslims believe taking credit is against religion and don’t encourage women financial independence

Segmented user testing

We internally user tested the app and specifically targeted orthodox muslims to define pain points and adjust the app

Language barriers

As main user segment speak only Arabic understanding user emotions and thoughts was challenging during user testing.

Live Translations

We conducted user testings over zoom with a live-speaking translator and we intervened when needed to do relevant follow up questions